Chinese and Russian space efforts may be supported by private equity and other financing from Western sources, particularly Europe. |

Security dimensions of space economics and finance

by Jana Robinson

Monday, September 25, 2023

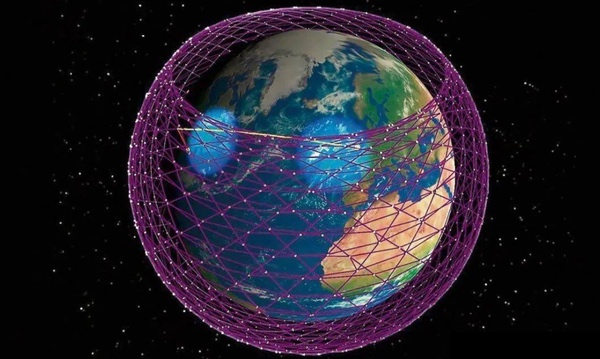

As of May 2023, there were more than 5,400 active satellites on orbit, and almost 3,000 of those are commercial. Some experts predict over 100,000 active satellites by 2030.[1] This, together with a significantly greater number of public and private actors in space, will lead to much greater pressure to keep the space environment viable and safe for commercial, civilian, and military activities.

| China and Russia long ago grasped the strategic potential represented by the merits of seeking to control the space sectors of foreign partners as a means of growing their global influence. |

Future space leadership will require an ability to forge durable partnerships, both between the public and private sectors as well as among nations. Indeed, space partnerships have gained greater prominence in the operational, political, and strategic competition presently underway among the major space powers.

In the US, private investors, such as Elon Musk, Jeff Bezos, and Richard Branson, have boosted interest in commercial space opportunities on the part of venture capital and private equity investors, who are now seemingly more willing to absorb the sizeable risks related to space activities. Europe has adopted a number of measures to support new investment in startups, as well as early and mature space companies, such as via the European Investment Fund and the European Space Fund.

China and Russia long ago grasped the strategic potential represented by the merits of seeking to control the space sectors of foreign partners as a means of growing their global influence. China’s Belt and Road Initiative, Made in China 2025, and China Standards 2035, as well as Russia’s regional and global outreach through its space sector, have served to multiply their power and influence abroad and, often times, ended up limiting the freedom of action of the countries targeted by vertically-integrated “partnerships” scheme. Pursuant to extensive research, PSSI has identified Chinese and Russian partnership arrangements with more than 80 countries.[2]

Building space infrastructure internationally with their technologies, equipment, and services is a substantive component of both China’s and Russia’s “ground-based space race.” The preferred vehicles for attracting space aspirants into their infrastructure fold are business transactions concluded with their state-controlled enterprises. To advance their strategic goals, however, China and Russia repeatedly circumvent or outright violate internationally accepted norms. China has, for example, routinely been accused of industrial espionage,[3] intellectual property theft,[4] extortionary practices, and heavily subsidized pricing and financing.

From a security perspective, China and Russia represent the greatest threat to Europe and its allies. Accordingly, it seems logical to also scrutinize the economic and financial (E&F) dimensions of their international activities. As referenced above, China uses its command economy to seek to manipulate the global financial system to serve its funding, lobbying, and other strategic needs. Of special interest to our Institute is the external sources of funding for these companies beyond the heavy subsidies and other financial support provided internally by the Chinese Communist Party and the country’s state banks (e.g., China Construction Bank, Industrial & Commercial Bank of China, etc.)

In short, there are a number of publicly traded Chinese space companies that are raising funds and trading on mainland exchanges (notably Shanghai and Shenzhen) as well as overseas capital markets, including those of the US and Europe (e.g., Beijing BD Star Navigation Company, Beijing Aerospace Changfeng Co. Ltd., etc.) However, Chinese space companies in search of capital are not limited to the issuance of publicly traded equities and bonds.

Not only do Chinese companies invest hundreds of billions of dollars into Western companies via Chinese state-backed investors,[5] but Western private equity investments also play a pivotal role across various stages of development of Chinese space companies through venture capital, growth equity, buyout funds, and more.

To provide a sense of scale, the private equity industry has grown over the past three decades from a niche financial services sector to an asset class of some $12 trillion as of June 2022.[6] Its rapid growth has turned it into an important—and less transparent—conduit for global capital flows, which China has seized on. The Chinese government views private equity as an attractive alternative to public equity offerings that dilute shareholder value and potentially undermine complete corporate control. Beijing may see such private equity deals as less likely to attract unwanted US and allied governments’ attention when compared with high-profile public offerings.

| The bottom line is that tens of millions of European investors are, albeit unwittingly, funding these malign Chinese and Russian space companies with their retirement and investment euros. |

Accordingly, the missing regulatory piece of this puzzle has to do with the funding side of Chinese and Russian space companies and commerce. In the US, there have been two presidential executive orders which state that US investors holding the securities (stocks and bonds) of Chinese Military Industrial Companies (CMICs) constitutes a “national emergency”.[7] That would include virtually all Chinese space companies, given that the entire space sector is under the control of the People's Liberation Army (PLA). It means that in the US, all such companies could be subject to American capital market sanctions, including delisting, deregistration, and outlawing the holding by American persons of these companies' securities. This issue needs to be urgently addressed in Europe as well or risk serious negative consequences for our own space sectors and those of prospective foreign partners.

This is not only relevant from the “investor protection” perspective, but also from a national security and human rights perspective, as Article 7 of China’s National Intelligence Law requires, on demand of the CCP, the weaponization of Chinese companies for espionage, military activities, and other strategic purposes.

The bottom line is that tens of millions of European investors are, albeit unwittingly, funding these malign Chinese and Russian space companies with their retirement and investment euros, often the same companies that will soon be—or are already—competing with European firms in emerging global space markets. If we in Europe fail to address this issue now, for fear of estranging China and/or not wishing to legitimate this new security risk category in the public and private equities markets, it could mean the loss of Europe’s competitiveness in a number of strategic space activities, foreign space sectors and other commercial markets.

Endnotes

- Irene Klotz, “Burgeoning Satellite Industry Paving way to $1 Trillion Space Economy.” Aviation Week, Aug 24, 2021.

- Robinson, Jana & al. “Strategic Competition for International Space Partnerships and Key Principles for a Sustainable Global Space Economy.” Prague Security Studies Institute, January 2022.

- Wu, Chu. “Tensions Mount over China's Industrial Espionage in US.” Voice of America, 2022.

- Wray, Christopher. “Responding Effectively to the Chinese Economic Espionage Threat.” FBI. Federal Bureau of Investigation, 2020.

- Agnew, Harriet. “Asset Management: China Cosies Up To Private Equity.” Financial Times, June 4, 2023.

- McKinsey & Company, “McKinsey’s Private Markets Annual Review,” McKinsey & Company, accessed March 22, 2023.

Note: we are using a new commenting system, which may require you to create a new account.

No comments:

Post a Comment