SpaceX’s next Super Heavy booster on the pad last week for tests ahead of a launch later this year. Vehicles like Starship/Super Heavy have the potential to reshape the industry based on their price and performance. (credit: SpaceX) |

The new era of heavy launch

by Gary Oleson

Monday, July 24, 2023

Three new commercial heavy launch vehicles with test launches scheduled during the next year may usher in a new age of space, depending on which succeed. The new heavy launchers are the Vulcan by United Launch Alliance (ULA), New Glenn by Blue Origin, and Starship-Super Heavy by SpaceX. Should these launchers prove themselves, many of the historic barriers to orbital entry will go away, leaving room to think about space industry in bold new ways. (Starship-Super Heavy will be called Starship in this paper because the Starship second stage is always launched on the Super Heavy first stage.)

SpaceX conducted the first test launch of Starship-Super Heavy on April 20, 2023, and ULA is conducting tests in advance of the first launch of Vulcan in late 2023. All three new heavy launchers have launch contracts.

| If even one fully reusable launcher succeeds, it will provide opportunities for dramatic cost savings not only in launch, but also in spacecraft design, manufacture, and deployment. |

This new generation of heavy commercial launch vehicles could enable two distinct revolutions in space economics: increased mass and volume capability, and full reuse. Success of Starship or New Glenn would produce a revolutionary increase in payload mass and volume available per launch. Vulcan is an evolutionary improvement that can launch nearly as much mass as the Delta IV Heavy with 36% more volume, which may not be enough to produce revolutionary change. Starship, by comparison, will launch more than five times as much mass as the Delta IV Heavy with more than four times the volume.

Efficient reuse of both the first and second stages would, in addition, create a breakthrough in launch costs. Reuse of both stages is designed into Starship. New Glenn has a reusable first stage with an expendable second stage and Blue Origin plans to develop a reusable second stage. ULA may develop a first-stage engine module that could be detached, recovered, and reused, but that would not put the Vulcan on a path to full reuse.

If even one fully reusable launcher succeeds, it will provide opportunities for dramatic cost savings not only in launch, but also in spacecraft design, manufacture, and deployment. These cost savings would be great enough to enable new industries in space that launch costs otherwise prohibit.

Sometimes quantity has a quality all its own

These launchers offer dramatic increases in payload volume and mass to orbit at costs per launch no greater than today’s vehicles. They would thereby create new opportunities for the space industry even if none of them reduced launch costs.

High launch costs for larger rockets have created historical incentives for designers to launch spacecraft on the smallest possible launchers. Even as launch costs have declined, limitations on payload mass and volume have sustained the incentives. The universal practice has been to invest in designs, materials, processes, and technologies that are more expensive, but enable decreases in spacecraft mass and volume. Increases in launch performance allow spacecraft designers to forgo most, if not all, of these expensive investments. Many programs may be able to save money by purchasing commercial systems and instruments that would otherwise have required alteration or substitution due to mass limits.

Savings such as these may comprise a significant portion of total program costs. Forgoing mass reduction investments and using off-the-shelf systems could bring additional benefits, such as shortening project schedules for additional time-related savings and putting satellites into service earlier. The new vehicles would also enable projects requiring too much mass or volume for current vehicles.

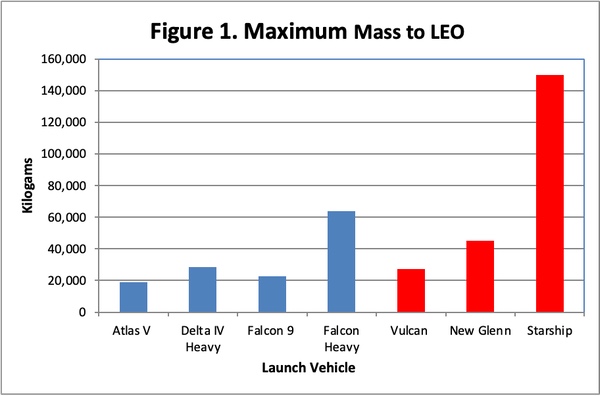

Payload Mass. Figure 1 shows the maximum mass to standard LEO for the three new heavy launchers, as well as the current Atlas V, Delta IV, and Falcon launchers for comparison. For purposes of this paper, a heavy launcher is defined as a launcher with maximum payload mass to standard LEO greater than the Falcon 9 delivers, currently 22,800 kilograms. Maximum performance for the Vulcan is achieved by adding six solid rocket boosters (SRBs) to the first stage.

|

The progression from Vulcan to Starship is clear. The high performance of Falcon Heavy is misleading because its relatively small payload fairing limits the payloads it can carry. The SpaceX estimate of the Starship mass performance to LEO was recently updated from 100+ to 150 metric tons (MT), revealing a wider gap with the others. SpaceX also estimates that Starship could launch 250 MT for an unspecified price if it expended both stages.

Launch performance to higher orbits is becoming more complex. The three new heavy launchers have different technical efficiencies in performing direct payload insertion into geosynchronous transfer orbit (GTO). Vulcan is the most efficient, placing 14.5 MT into GTO, 53% of its LEO performance. New Glenn places 13 MT into GTO, 29% of its LEO performance. Starship is least technically efficient at 14 percent of its LEO performance, but that places a best-in-class 21 MT into GTO. Furthermore, Starship could transport its entire LEO cargo to higher orbits by refueling in LEO. In addition, some spacecraft now provide their own propulsion beyond LEO and new orbital transfer vehicles are being developed to expand the range of choices.

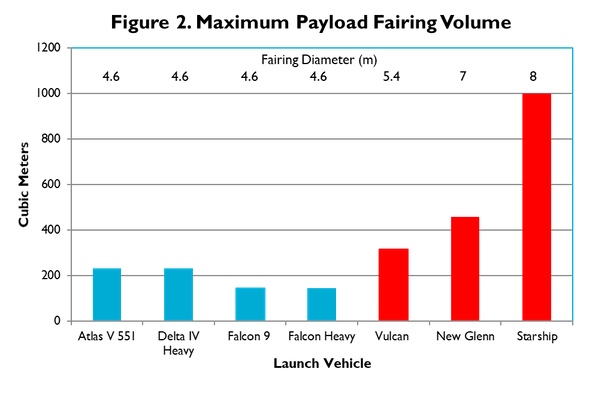

Payload Volume. Figure 2 shows the maximum payload fairing volumes for the launchers.

|

As mass limits have relaxed over the last decade and small satellites have grown as a payload class, volume has emerged as a more important limit on spacecraft. Fitting spacecraft systems into a small volume is an increasingly frequent engineering challenge. Comparing Figure 1 with Figure 2 shows that launch companies have now designed payload fairing volumes for their new launchers that align much better with their mass performance. While the Delta IV Heavy has 8 cubic meters of volume per metric ton of mass to LEO and Falcon Heavy has only 2 cubic meters. Vulcan has 12 cubic meters, New Glenn has 10 cubic meters, and Starship has 7 cubic meters per ton.

| In this new era, the paradigm of gaining cost savings and additional performance from relaxed mass and volume limits is a matter of choice and opportunity, seeking to make best use of both higher-tech and lower-tech options. |

Payload fairing envelope diameter is an important limit for some payloads. While the diameter of all the current vehicles is about 4.6 meters, Vulcan’s diameter is 5 meters, New Glenn’s is 7 meters, and Starship’s is 8 meters. The larger diameters will open useful design options for some applications, such as space telescopes. For example, Starship could launch a space telescope with a monolithic mirror having two to almost three times the diameter of the Hubble Space Telescope’s 2.4-meter mirror.

Benefits of relaxed mass and volume limits. Designing large margins and devaluing optimization are two closely linked systems engineering approaches to reducing mission cost. Large margins reduce cost and the potential for cost and schedule overruns in many ways, including simplifying manufacturing processes, using more commercial and standardized components, and using heavier and cheaper materials.

Many of these cost-saving design changes could also produce spacecraft that are more robust and reliable, in turn reducing project risk. In addition to cost savings, budgets may also allow for relatively low-cost performance improvements, such as adding more fuel, larger solar arrays and batteries, or heavier radiation shielding.

These improvements could enable a cascade of additional savings. Increased fuel loads could increase lifecycle benefits by extending spacecraft lifetimes. Adding more power production could eliminate the need for some expensive investments to reduce power consumption. Broad relaxation of limits on power, in addition to mass, could further ease the challenge of inserting new technologies that have not yet been optimized to reduce their mass and power requirements.

The cost-saving benefits could cascade from mass to power and thermal control and then to mission systems. The cumulative effect is likely to improve the benefits and decrease the costs of using modularized or standardized systems. The design space for spacecraft will expand in many dimensions.

In this new era, the paradigm of gaining cost savings and additional performance from relaxed mass and volume limits is a matter of choice and opportunity, seeking to make best use of both higher-tech and lower-tech options. Expanded systems engineering frameworks and more flexible cost models could provide crucial assistance to these analyses.

Price versus cost

It’s useful to understand the dynamics of prices in the launch business before we discuss cost assessment. The price of a launch is the cost to the customer, but it is not necessarily an accurate reflection of the cost to the launch company. None of the companies have officially released launch prices for their new heavy launchers, but some of their senior executives have made comments. All three companies have stated that their prices will be competitive, which depends heavily on the behavior of their competitors and the market. Any estimated price must, therefore, be regarded as a starting point or perhaps a central tendency. When the distance between the starting points is great enough and backed by logic, however, we can begin to make comparisons between launchers.

To begin, there is always uncertainty in the original estimate. In addition, there may be discounts. SpaceX offered discounts for Falcon 9 launches prior to their first successful launch, offered discounts again to encourage the first customers for reused Falcon 9 first stages, and still offers modest discounts for multi-launch contracts. There are frequent surcharges as well for any special handling, paperwork, or engineering work required by a launch customer. Government launches frequently have surcharges in the $10–20 million range. Beyond all that, market conditions may allow higher prices or force lower ones.

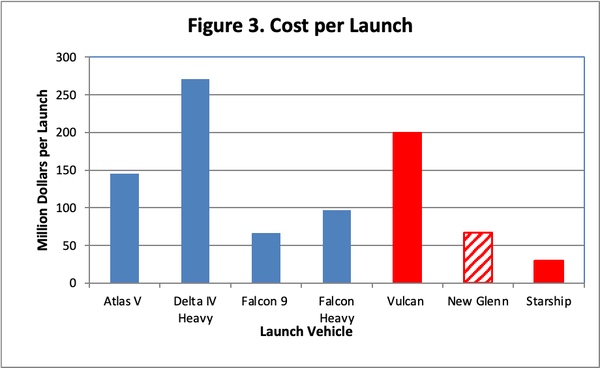

ULA CEO Tory Bruno told a news conference at the 2015 Space Symposium in Colorado that Vulcan would cost about $100 million for a medium-lift booster and about $200 million for heavy-lift variants, assuming use of a reusable first-stage engine module that has not yet been developed. That was eight years ago and argues for a higher current estimate since costs for aerospace programs rarely decrease over time.

In August 2020, ULA won a $224.3 million Phase 2 National Security Space Launch (NSSL) Launch Service Procurement (LSP) contract for two Vulcan launches with four SRBs each, two SRBs fewer than the maximum of six. Allowing for special-service surcharges, this would argue for a much lower base-price estimate than Bruno’s 2015 estimate, except that ULA also won a $967 million Phase 1 NSSL Launch Service Agreements (LSA) contract in August 2018 to facilitate the development and certification of Vulcan as an NSSL vehicle. This Phase 1 LSA investment might have enabled ULA to discount the price of the Phase 2 LSP contract. While it is unlikely that Bruno’s eight-year-old estimate of $200 million is accurate, there is not yet sufficient evidence to estimate an alternative.

As a side note, an NSSL Phase 2 LSP also awarded a second pair of launches to the SpaceX Falcon 9 for $159.7 million. This contract is consistent with the Falcon 9 list price of $67 million per launch, leaving about $26 million for surcharges. SpaceX was not given an NSSL Phase 1 LSA contract but received other contracts to support Falcon 9 development a decade earlier.

| The new launchers display an unprecedented characteristic: the least capable is the most expensive and the most capable is least expensive. |

New Glenn presents a different challenge. There are no data available on its internal costs or pricing strategy, on any need to cover sunk costs, or on any possible discounts. This is a testament to the security of Blue Origin’s operations. In this data vacuum, we are left to form estimates by analogy. Arguing that the New Glenn configuration of a reusable first stage with an expendable second stage is similar to the Falcon 9 configuration suggests that a similar price would be appropriate. In the absence of any other information, there’s no reason not to use the Falcon 9 price of $67 million as New Glenn’s starting point.

On February 10, 2022, SpaceX CEO Elon Musk announced he was highly confident that Starship launch prices “would be less than $10 million all in, fast forward two or three years from now," including all SpaceX expenses. He also said a Starship flight could cost a few million dollars or “maybe even as low as a million dollars per flight” in the future. SpaceX has a history of hitting its launch prices, so these targets should be taken seriously as long-term possibilities if the flight rate gets high enough.

For the immediate term, SpaceX recently released some price information. Gary Henry, senior advisor for national security space solutions at SpaceX, told the Space Mobility conference on February 21, 2023, that SpaceX is forecasting a cost of $200 per kilogram. If that forecast is against the previous 100 MT payload estimate, it implies a price of $20 million per flight. If it is against the new 150 MT estimate, it implies $30 million per flight. Caution suggests that $30 million is a good starting point, but that number is still in advance of surcharges.

Figure 3 shows published or estimated costs per launch for the launchers. The New Glenn estimate is striped because it is based totally on analogy rather than data.

|

We should have low confidence in the precision of any price estimates for the new launchers, but moderate confidence in their central tendencies. Vulcan is fully expendable, New Glenn is first-stage reusable, and Starship is fully reusable. These design differences drive cost differences that outweigh errors in price estimates that might otherwise be considered large.

SpaceX may initially have little incentive to price Starship launches much below New Glenn and Vulcan prices. In competitions for launch contracts, the cost per launch is often more important than the cost per kilogram because few payloads use the full capacity of the launcher. This will be especially true in the early years of Starship launches and continue until larger and heavier payloads are developed. If New Glenn is priced at $67 million per launch with an expendable second stage, for example, SpaceX may price Starship launches at just a little less until New Glenn has a reusable second stage and becomes fully price competitive.

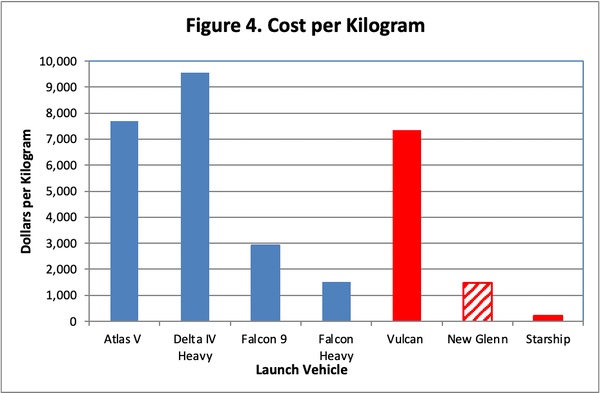

The cost breakthrough

The new launchers display an unprecedented characteristic: the least capable is the most expensive and the most capable is least expensive. This is the effect of reusability. Figure 4 shows that full reusability in combination with capability increase moves us into a new and unprecedented economic domain. New Glenn is about twice as cost effective as the Falcon 9 due to its larger size, but Starship is about seven times as cost effective as New Glenn due to its still greater capability and lower cost.

|

Reducing launch costs this much will remove launch as a prohibitive budgetary constraint for many projects. That will reinforce the cost of space systems as the dominant budgetary constraint. The next era of space engineering will explore how much the cost of space systems can be reduced with relaxed mass and volume constraints. New limiting factors are likely to be found in the base cost of systems and robotics needed for assembly and maintenance.

The Starship cost per kilogram is so low that it is likely to enable large-scale expansion of industries in space. For perspective, compare the cost of Starship launches to shipping with FedEx. If most of Starship’s huge capacity was used, costs to orbit that start around $200 per kilogram might trend toward $100 per kilogram and below. A recent price for shipping a 10-kilogram package from Washington, DC, to Sydney, Australia, was $69 per kilogram. The price for a 100-kilogram package was $122 per kilogram. It’s hard to imagine the impact of shipping to LEO for FedEx prices.

The full impact of such huge payloads being launched for such low costs will evolve from the interplay of innovation and market forces and are thus impossible to fully anticipate in advance. Industrialization of space is at a point similar to computing just before the introduction of the personal computer or telecommunications just before the introduction of the Internet.

Some broad developments can be anticipated even at this early stage. The following list captures some of them:

- Deploy large constellations of small satellites with a single launch

- Deploy space stations with much larger crews and laboratory space

- Support vastly expanded personal and corporate space travel

- Deploy larger space instruments and systems

- Support large-scale satellite refueling and orbital transportation services

- Support large-scale infrastructure assembly and maintenance

- Deploy space-based solar power stations

- Support space-based manufacturing and resource extraction

- Enable suborbital point-to-point intercontinental travel

NASA has contracted with SpaceX to provide lunar landers for Artemis using Starship’s ability to be refueled in orbit. This ability could enable Starship to deliver up to 150 MT to cislunar space and beyond. The mixed cargo/passenger design of the Starship lunar lander suggests possibilities for LEO transportation. Launch costs for a mixed cargo/passenger version of Starship might be fully paid by the cargo with passenger seats priced at the marginal cost of passenger service alone, reducing cost per seat by orders of magnitude from current prices.

The sheer size of the new launch vehicles may create demand for new services. It may be impractical for Starship and other large LEO transports to dock with many of the space stations and industrial facilities that they serve, creating demand for ship’s tenders to transfer cargo and passengers from the transports to nearby destinations. Other ships might take cargo from the LEO transports to farther destinations.

A few entrepreneurial space companies are already building space systems designed for the Starship era, including at least one commercial space station supplier that is using lower-cost terrestrial manufacturing techniques to produce large, heavy structures that only Starship can lift.

| The new heavy launchers will relax mass, volume, and launch cost as constraints for many projects. Everyone who is concerned with future space projects should begin asking what will be possible. |

Space-based solar power production could be enabled by Starship if the cost of in-space systems can be contained. One reference design for a two-gigawatt power station would weigh 7,500 MT. Earth to LEO transportation for such a station would take 50 Starship launches or more than 130 Falcon Heavy launches with reuse. Using Starship would cost about $0.5 billion since a two-gigawatt station probably won’t be built until long after Starship launch costs reach $10 million per launch. Using Falcon Heavy at today’s prices would cost over $12 billion. None of the current launchers could support price-competitive space-based solar power. Fully reusable launchers could. Recognizing this, Japan’s planning for space-based solar power is predicated on Starship launches.

What could you do with 150 metric tons in LEO for $10 million?

The new heavy launchers will relax mass, volume, and launch cost as constraints for many projects. Everyone who is concerned with future space projects should begin asking what will be possible. Given the time it will take to develop projects large enough to take advantage of the new capabilities, there could be huge first mover advantages. If you don’t seize the opportunity, your competitors or adversaries might. Space launch at FedEx prices will change the world.

References

Blue Origin. “New Glenn.”

Duffy, Kate. “Elon Musk Says SpaceX Starship Flights to Cost Under $10M in 2-3 Years.” Business Insider, February 11, 2022.

Foust, Jeff. “Inflation, high demand driving up launch prices.” SpaceNews, March 26, 2023.

Garretson, Peter. “The Starship Singularity.” American Foreign Policy Council, February 2023.

Shalal, Andrea and Irene Klotz. “'Vulcan' rocket launch in 2019 may end U.S. dependence on Russia.” Reuters, April 13, 2015.

SpaceX. “Starship.”

SpaceX. “Falcon User’s Guide.” September 2021.

SpaceX. “Capabilities & Services.”

United Launch Alliance. “Rockets.”

Note: we are using a new commenting system, which may require you to create a new account.

No comments:

Post a Comment